Oklahoma Property Taxes and What They Mean for Landlords in 2025

Introduction: What 2025 Oklahoma Property Taxes Mean for Landlords

If you’re a landlord in Oklahoma—or thinking about becoming one in 2025—understanding property taxes isn’t just a box to check. It’s a crucial part of keeping your rental business profitable and stress-free.

Oklahoma may be known for its relatively low property tax rates compared to other states, but that doesn’t mean landlords are off the hook. In fact, 2025 is shaping up to be a pivotal year, with reassessments, local millage rate changes, and new legislation rolling out across cities like Edmond, Oklahoma City, and Norman.

Whether you own a single-family rental, a multi-unit property, or a small portfolio spread across counties, property taxes will directly impact your cash flow, long-term strategy, and how you budget for the year ahead.

In this article, we’ll break down:

How Oklahoma property taxes work

What’s changing in 2025

How those changes affect you as a landlord

Smart steps to protect your profits and avoid surprises

If you're looking for a clear, straightforward guide tailored to Oklahoma landlords in 2025, you're in the right place. Let’s dive in.

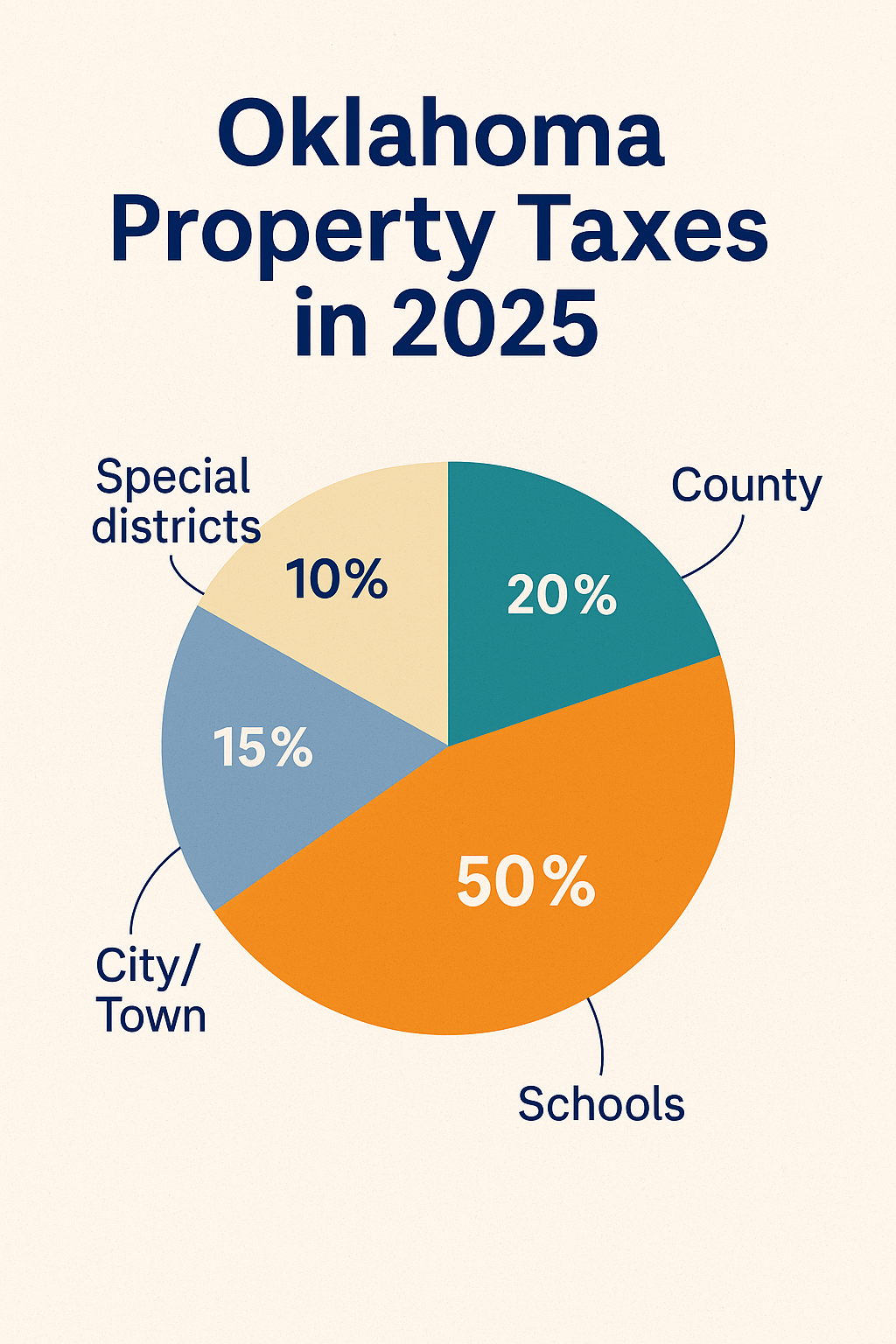

How Oklahoma Property Taxes Work

Before you can plan ahead as a landlord, it’s important to understand exactly how Oklahoma property taxes are calculated—and why they matter to your bottom line.

The Basics of Oklahoma’s Property Tax System

Oklahoma uses an ad valorem tax system, meaning property taxes are based on the assessed value of your property. But unlike some states that assess at full market value, Oklahoma applies a fractional percentage:

Residential properties are assessed at 11% of fair market value

Commercial properties, including rental properties, are typically assessed at 11%–13.5%, depending on the county

Once the assessed value is calculated, it’s multiplied by the local millage rate to determine your final property tax bill.

✅ Example: If your rental property is worth $200,000 and the county assesses it at 11%, the taxable value is $22,000. If your millage rate is 100 mills (or 10%), your annual property tax would be $2,200.

Millage Rates Vary by Location

Every county and school district sets its own millage rate—which is why you’ll pay more in some areas than others, even for similar properties. For example, Edmond and Deer Creek may have higher rates due to funding local schools or infrastructure projects.

To see your exact millage rate or check your local tax assessor’s page, you can use the Oklahoma Tax Commission's property tax resource.

Compared to the National Average

Oklahoma property taxes are generally among the lowest in the U.S., with an effective rate of around 0.74%. That’s well below the national average, which sits closer to 1.10%. For investors and landlords, this lower tax burden makes Oklahoma a more attractive place to hold long-term rental properties.

But don’t let the lower rate fool you—understanding how and when values are assessed can still make or break your yearly cash flow.

Key 2025 Changes in Oklahoma Property Tax Law

For landlords across Oklahoma, 2025 isn’t just another year on the calendar—it’s a year of change. Between legislative updates, shifting market conditions, and new millage rates in several fast-growing areas, Oklahoma property tax changes in 2025 could have a direct impact on your rental portfolio.

Legislative Updates and Local Reforms

In 2024, Oklahoma lawmakers approved several bills designed to increase funding for education, transportation, and emergency services—many of which are being implemented in 2025. These changes allow counties and school districts to adjust local millage rates, which could lead to noticeable tax hikes for property owners in some areas.

If you're investing in or managing rentals in growth zones like Edmond, Moore, or Oklahoma City, keep a close eye on school bond approvals and infrastructure-related votes. These can drive millage rates higher without much notice.

🏛️ Pro tip: Check local county commissioner agendas and municipal ballots to stay ahead of tax-affecting initiatives. You can also explore statewide legislative summaries from resources like Oklahoma Policy Institute to stay informed on new laws.

Reappraisal Cycles and Assessed Value Increases

While Oklahoma caps annual increases in assessed value at 3% for homesteads, that protection doesn’t apply to investment or rental properties. This means if your property’s market value has jumped significantly—especially in high-demand areas—your assessed value may rise more sharply in 2025.

And it’s not just about new purchases. Counties often conduct mass appraisals every few years. If your area is due in 2025, you might receive a reassessment notice that raises your taxable value, even if your rental income hasn’t increased at the same pace.

Shifting the Landscape for Landlords

What makes 2025 different from previous years is the convergence of rising home values, millage increases, and reassessments all at once. For landlords, this triple threat could lead to higher expenses, tighter margins, and unexpected budget stress—especially if leases are locked in at 2023 or 2024 rates.

In short, Oklahoma landlords in 2025 need to be more tax-aware than ever before. Understanding local tax trends now can save you from a surprise bill later.

How Property Taxes Affect Landlords in Oklahoma

As a landlord, property taxes aren’t just a line item on your budget, they can make the difference between healthy cash flow and a financial headache. And in 2025, with assessment changes and rising millage rates across many parts of Oklahoma, it's more important than ever to understand how property taxes truly affect your rental business.

Property Taxes and Your Cash Flow

For landlords in cities like Edmond, Norman, and Oklahoma City, property taxes are a recurring operating expense that can significantly cut into your profits, especially if you’re not adjusting rents or lease structures to keep pace.

Let’s break it down with a simplified example:

🧮 Scenario: You own a 4-plex in Edmond valued at $200,000.

In 2024, with a millage rate of 95 mills and assessed value at 11%, your annual property tax was around $2,090.

In 2025, after reassessment and a rate increase to 105 mills, your new tax could jump to $2,310 or more.

That’s a $220 difference, not devastating on its own, but when spread across multiple properties, it adds up fast. And if rents stay flat, that extra cost comes straight out of your bottom line.

Impact on Profit Margins and Rent Strategy

Rising taxes squeeze your net operating income (NOI), especially if your other costs (like insurance, repairs, or management fees) are also increasing. This often leads landlords to:

Adjust renewal rates more aggressively

Build tax pass-throughs into lease agreements (especially for commercial or multi-unit properties)

Re-evaluate low-performing properties in high-tax areas

It's not just about reacting to increases—it's about planning proactively to ensure long-term stability.

Why Even Small Changes Matter

A few hundred dollars per year might seem minor, but for investors with larger portfolios or tight margins, compounding tax hikes can throw off projections, limit capital improvements, or even change your investment strategy altogether.

That’s why seasoned investors regularly review their pro forma models and adjust for market shifts. If you’re just getting started as a landlord in Oklahoma, understanding how taxes affect your cash flow now will save you from costly surprises later.

For more help with running accurate numbers, check out the Oklahoma County Assessor’s website where you can look up tax records, assessments, and estimated bills.

Tax Exemptions, Protests, and Deductions Landlords Should Know

When it comes to property taxes in Oklahoma, knowledge isn’t just power, it’s profit. While landlords don’t qualify for some of the tax breaks available to homeowners, there are still important tools you can use to lower your tax liability or at least make sure you’re not overpaying.

No Homestead Exemption for Rental Properties

First things first: the homestead exemption, which helps reduce taxable value for owner-occupied residences, does not apply to investment or rental properties. That’s one of the most common misconceptions among new landlords in Oklahoma.

If your property is occupied by tenants (not yourself), it's considered commercial for tax purposes—even if it’s a single-family home.

What Exemptions Might Still Apply?

Although landlords can’t claim homestead exemptions, there are limited-use exemptions that might apply depending on your situation:

Agricultural exemption (for land meeting farming use standards)

Senior tax freezes (if the property is owned by a senior and used as their residence—less relevant for investors but worth knowing)

Charitable or nonprofit property uses (in very specific cases)

You Can Protest Your Assessment

Even if you don’t qualify for an exemption, landlords still have one important power: the right to protest your assessed value.

If you believe your county assessor overvalued your property or used outdated comps, you can file a protest within 30 days of receiving your assessment notice. Common reasons to file include:

Incorrect square footage or features listed

Drastically higher assessment compared to similar nearby properties

A recent purchase price lower than the assessed market value

Many landlords overlook this option, but successful protests can save hundreds—or even thousands—over time.

🛠️ Tip: Keep detailed records of repairs, comps, and leases. Documentation is key when making a case.

Federal Deductions: Don’t Leave Money on the Table

While state-level exemptions are limited, property taxes on rental properties are 100% deductible on your federal income taxes as a business expense.

That means even if your Oklahoma tax bill increases in 2025, it can reduce your taxable rental income if you’re reporting everything correctly. If you haven't already, talk to a CPA who specializes in real estate investments to make sure you're maximizing your deductions.

Best Practices for Landlords Navigating 2025 Tax Changes

If you're managing rental properties in Oklahoma, rising property taxes in 2025 don’t have to derail your profitability. A few smart strategies can help you stay ahead, minimize surprises, and build a more resilient rental business.

1. Adjust Budgets to Reflect Tax Increases

Property taxes should be treated like any other recurring expense—planned for in advance. When taxes increase mid-year (due to reassessment or millage changes), landlords who haven’t budgeted for it may find themselves scrambling.

Proactive budgeting tips:

Build a 3–5% buffer into your annual expense forecast

Use last year’s tax data as a base, then factor in expected millage hikes

Reassess your property’s cash flow projections mid-year

Need help planning your cash flow? The Oklahoma Real Estate Commission offers public resources that can help landlords and investors better understand real estate operating costs.

2. Reserve Funds Are Your Safety Net

It’s smart to have a dedicated reserve account for each rental property or portfolio. These funds can cover unexpected tax increases, repairs, or insurance spikes without disrupting your operations.

If you’re not already setting aside reserves, start with:

10% of monthly rent as a general rule

Higher percentages for older homes or properties in high-tax areas

3. Update Lease Terms to Reflect Tax Realities

In some cases, landlords can legally pass along tax increases to tenants—especially in commercial leases or multi-unit properties with triple-net or CAM agreements. While this isn't common in single-family residential leases, you can still:

Add clauses that allow rent adjustments tied to tax reassessments

Use lease renewals as a time to factor in updated operating costs

Communicate transparently with tenants about tax-related increases

Renters are more understanding when increases are clearly tied to external factors, like property tax hikes, not just arbitrary rate bumps.

4. Partner With a Real Estate CPA or Tax Professional

Tax law is always changing. A real estate-savvy CPA can help you:

Maximize federal deductions

Time expenses for tax efficiency

Strategize long-term depreciation and cost segregation

Identify opportunities to appeal assessments effectively

A good accountant more than pays for themselves—especially when your margins tighten.

Quick Tip: Even if you manage your own properties, consider meeting with a pro once a year. Think of it as a tax check-up for your business.

Conclusion: Stay Ahead of Oklahoma Property Taxes in 2025

Property taxes are one of the few landlord expenses that you can’t ignore or delay—and in 2025, staying informed is more important than ever. With shifting millage rates, new legislation, and rising property values across Oklahoma, landlords need to take a proactive approach to budgeting, planning, and lease management.

Here’s what we covered:

How Oklahoma’s property tax system works

What changes are happening in 2025—and why they matter

How taxes impact your cash flow, margins, and rental pricing

What exemptions and deductions you can still take advantage of

Smart strategies to prepare, respond, and protect your investments

At NBHD Property Management, we’re here to help you make confident, informed decisions that keep your rentals running smoothly—no matter how the tax landscape changes.

Want Help Navigating 2025's Market?

Let’s talk. Whether you need help planning your property taxes, adjusting your lease strategies, or just want someone to take the hassle off your plate, our team is here for you.

📞 Contact us today or schedule a consultation to get personalized guidance from local experts who know the Oklahoma rental market inside and out.